Award-winning PDF software

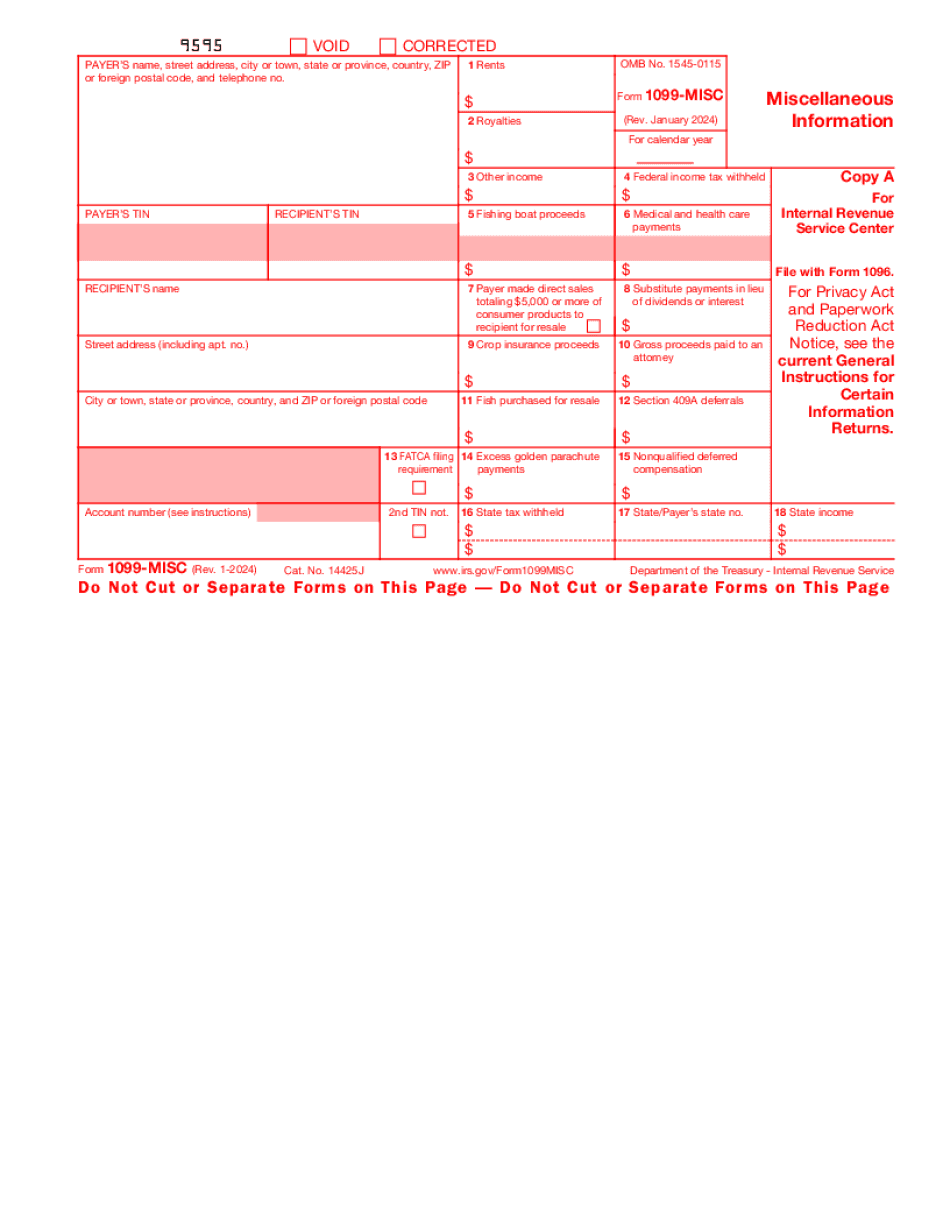

Form 1099-MISC MS: What You Should Know

February 28, 2025 (1099-MISC) February 28, 2025 (1099-NEC) February 28, 2025 (1099-R) Required supporting documents for reporting: 1099-MISC; 1099-NEC; and 1099-R Missouri 1099 and Income Tax Exemptions To calculate Missouri state income tax, add up your reported salaries and then determine, based on your total amount of earnings, whether your Missouri income tax liability is either an income tax credit or tax credit over and above what you pay federal taxes on your wages. For example, if you earn 40,000 and have paid 17,000 in federal income tax and 5,000 in Missouri income tax, your state income tax liability for 2025 would be 21,480. Tax credits are deductions that reduce taxes. Missouri Income Tax Filing Requirements MMS Form 2810 | E-File MT 2810 For Form 2810, see Missouri Income Tax Requirements. Missouri State Reporting Rules Missouri income tax rules apply to all taxpayers in the state for the year in the following manner except for: 1. An individual making the first 11,000 in income or a married couple filing a joint return with adjusted gross income (AGI) of more than 50,600 whose combined AGI is less than 38,080. 2. An individual who is not required to file taxes. If the individual files his or her taxes in the regular due date then the date should be set for July 29, 2017. Missouri Tax Credits MRS Section .01 The tax credits are based on total income and not on whether they are earned. The tax credits are subject to withholding. The tax credits are available on a calendar year basis. This method is used most to take advantage of the Earned Income Tax Credit (ETC), however, it is not limited to the ETC. The total amount of the tax credit is calculated as follows: The tax credit is first applied to Federal taxable wages earned during the tax year. The credits may be claimed by the taxpayer, his or her spouse or any dependent who is under age 18 and permanently and totally disabled.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-MISC MS, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-MISC MS?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-MISC MS aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-MISC MS from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.