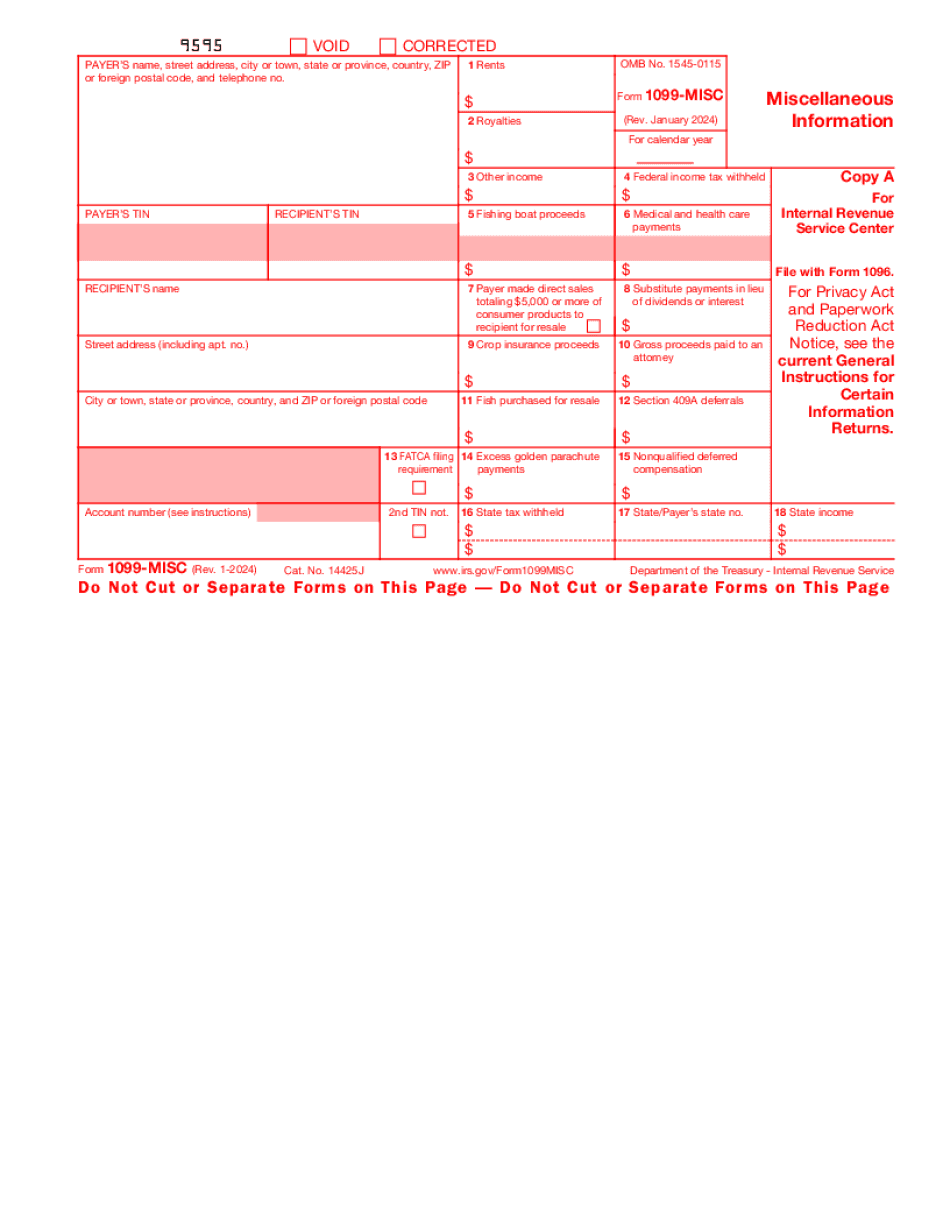

Form 1099-MISC 2024-2025

Show details

Hide details

Cluding apt. no. City or town state or province country and ZIP or foreign postal code 9 Payer made direct sales of 10 Crop insurance proceeds 5 000 or more of consumer products to a buyer recipient for resale FATCA filing 2nd TIN not. 13 Excess golden parachute requirement payments Account number see instructions 15a Section 409A deferrals Cat. No. 14425J 16 State tax withheld www.irs.gov/Form1099MISC Copy A For Internal Revenue Service Center File with Form 1096. For Privacy Act and ...

4.5 satisfied · 46 votes

printable-1099-form.com is not affiliated with IRS

Filling out Form 1099-MISC online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guideline on how to Form 1099-MISC

Every person must declare their finances in a timely manner during tax period, providing information the Internal Revenue Service requires as accurately as possible. If you need to Form 1099-MISC, our trustworthy and straightforward service is here at your disposal.

Follow the steps below to Form 1099-MISC quickly and precisely:

- 01Import our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Go through the IRSs official instructions (if available) for your form fill-out and attentively provide all information required in their appropriate fields.

- 03Complete your document using the Text option and our editors navigation to be confident youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the tool pane above.

- 05Take advantage of the Highlight option to stress particular details and Erase if something is not relevant any longer.

- 06Click the page arrangements button on the left to rotate or delete unnecessary document sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to make sure youve provided all details correctly.

- 08Click on the Sign tool and create your legally-binding electronic signature by adding its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your tax statement from our editor or choose Mail by USPS to request postal document delivery.

Select the most efficient way to Form 1099-MISC and report on your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is 1099-MISC Form?

The 1099 MISC form is indented for your use in case you are an independent contractor or a freelancer. It is necessary to report income, other than wages salaries and tips to the IRS. Rental property income, earnings from interest and dividends, sales proceeds and other miscellaneous revenue may be included.

This document may also apply to your situation if you make more than $600 working as a contractor. In case, you work for more than one client, it is obligatory for you to complete a 1099 MISC form for each client youve performed services for.

It is convenient to submit the paper electronically in PDF format. You may use fillable templates that are available online. Just insert the required information into the fillable fields. Customize and edit according to your needs. Here is the brief guide of how to prepare the 1099 MISC form correctly.

Follow the instructions below to avoid any possible mistakes.

- 01Insert your personal data: name, address, contact number(s) and ZIP code.

- 02Indicate the social security numbers of both payer and recipient.

- 03Specify rents, royalties or other income. Pay attention to the figures you prto avoid any misunderstanding.

- 04Insert the current date.

- 05Sign the file. You can add your signature by typing, drawing or uploading it.

- 06Forward the document to the addressee.

Note that you must submit the completed document to the IRS by January 31st of the tax-filing year.

Online answers make it easier to prepare your document administration and strengthen the efficiency of one's workflow. Adhere to the fast handbook with the intention to full Form 1099-MISC, keep away from mistakes and furnish it in the timely manner:

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 1099-MISC?

Form 1099-MISC is designed to help the IRS calculate what it costs you to pay certain taxes. A 1099-MISC is a summary of the taxes that you owe to the IRS. The following table summarizes the key elements of an employer identification number (EIN):

E-Verify

Employers must issue an EIN to a U.S. taxpayer in order to ensure that the taxpayer is working as an employee and paying Social Security and Medicare taxes. You can use E-Verify or other identification methods to verify your EIN.

For further information, see E-Verify and the IRS's website:

E-Check

A taxpayer can also use E-Check to verify the taxpayer's identity. E-Check is not available for individuals who use a debit card or pay by check.

For further information, see E-Check and the IRS's website:

E-Pays

Employers may also issue an E-Pays certificate to an employee. The employer and employee can share the employer identification number for the E-Pays certificate.

Form 1099-MISC can also be requested by contacting IRS.

IRS Form 1099 Miscellaneous Information

The following is a list of other instructions, instructions for use, and other pertinent information related to Forms 1099-MISC.

E-Verify (Employer Identification Number)

When using any electronic method of payment (e.g., credit card or debit card), you must complete an E-Verify form. You must use the number provided on your Form W-2 for employment tax purposes or a number provided to you by your employer. You can find an E-Verify form or use the link below:. Furthermore, you must use the form online or through an automatic feeder when completing the online form.

If you are receiving unemployment compensation benefits you must complete an E-Verify form, which is a question and answer booklet. There are two versions. E-Verify is not available for individuals who use a debit card or pay by check.

Who should complete Form 1099-MISC?

The form is especially important for some types of business transactions, including

Selling stock

Paying employee bonuses/income

Rent and mortgage payments

Real estate transactions

Payments for items and services for which you should be reimbursed by the purchaser (ex.: car repairs)

Selling real estate to another person

Selling to another business which is related to that person

Note: You do not have to complete Form 1099-MISC if the transaction is a gift or other bequest to your organization. For more info, see Don't Make a Form 1099-MISC for gifts to your organization.

Why do business owners need to report these payments?

Business owners who received money from a former employee should file Form 1099-MISC to report the payments. Most of the employees paid the money personally, though the employer made more than one payment. The IRS has no reason to believe that the payments were made for anything other than employer business. As with all noncash payments to any individual, if it is reasonable to do so, you should report on Form 1099-MISC the value of the amount paid to the employee, plus any income tax you are required to pay.

Can I use Form 1099-MISC as a way to obtain an employee discount on some purchases?

No. The Form 1099-MISC is intended to provide a record of payments received by businesses and for payment by a former employee to avoid problems later. Thus, Form 1099-MISC may not be used by most businesses in the absence of actual payment of actual money to the employee.

If you receive a Form 1099-MISC, you can make a return, however, and you should complete Schedule B (Form 1040) and Part I (Form 1040) to include the Form 1099-MISC payment (and any income tax due).

Can I use Form 1099-MISC to pay taxes on my employee bonus?

No. You must pay the tax on the tax-free salary. You must also file an income tax return to determine the amount of income tax you must pay. See the Publication 549, U.S. Income Tax Forms and Instructions, for more information.

When do I need to complete Form 1099-MISC?

You must complete Form 1099-MISC within five years of when the income was earned. If the income is not reported until the end of the 10-year period, you don't need to report it. If the income is reported in the 10-year period or later, you still need to complete Form 1099-MISC and get the statement showing the year of the income earned and the Form 1099-MISC form number assigned to it.

Are there any other information that must be reported on Form 1099-MISC?

No. The requirements for this item are the same as the requirements for the other items listed in chapter 4.

Chapter 6: How to Find and Report Information

What's the difference between a Form 1099-MISC and Form W-2?

A Form 1099-MISC is a tax accounting report. A Form W-2 is a check of the wages paid by a company to an employee. The form 1099-MISC and Form W-2 have the same information.

How do I find a Form 1099-MISC?

Use IRS.gov to search for Form 1099-MISC forms. Go to IRS.gov or the IRS website and search for the form 1099-MISC and follow the onscreen instructions.

How do I get an IRS.gov e-mail address to use when I'm researching Form 1099-MISC?

Use the contact information for your local Revenue Officer who handles all returns from the IRS to reach a regional office in the United States at, toll-free.

Can I create my own Form 1099-MISC?

In a nutshell, you can create Form 1099-MISC form for your business if your business pays certain taxes, even if you don't pay the individual income tax. The IRS is now accepting applications directly from you, and you'll also receive email updates and other helpful features.

Forms 1099-MISC — How to Prepare

Now you can prepare Form 1099-MISC when you're collecting money from one or more business owners (for example, for payment of taxes, refunds, or sales of inventory). You're not required to fill out the completed Form 1099-MISC; instead, you will be provided as an attachment to the Form 1099-MISC payment form, which you are then expected to complete, sign (but do not send in), and file with the IRS with all the required information.

If your business has employees, you must also submit documentation that shows you're taking a tax deduction on their wages. This is called payroll evidence.

Your company will then be expected to keep the supporting documentation for 2 years. If you don't send this documentation with the Form 1099-MISC, the IRS will assume that you are using Form 1099-MISC instead of a regular pay stub. You must submit the supporting documentation at least 30 days before your tax filing deadline; if you miss this deadline, you'll need to resubmit the documentation and may be penalized in some instances (such as losing certain exclusions that you're required to include) or face additional tax penalties.

If you receive the IRS notice in October of a “final tax withholding,” you must submit the completed Form 1099-MISC and supporting documentation before the due date of the income tax to file your return.

You can learn more about submitting Form 1099-MISC by reviewing our Form 1099-MISC video, or by accessing the complete Form 1099-MISC Instructions.

Learn why it's important to pay your taxes and how to report them on a Form 1006. To find out how you can pay your taxes on a credit card using Form 1099-MISC, read our article, “How Do You Pay Your Income Taxes? With a Form 1099-MISC.

What should I do with Form 1099-MISC when it’s complete?

You have to file Form 1099-MISC. This includes Forms 1099-MISC for all business transactions.

You need to file Form 1099-MISC to calculate your allowable deduction. To file Form 1099-MISC, the business has to be:

an employer or employee of a U.S.-based U.S. subsidiary or affiliate that participates in a U.S. service delivery network, or that provides services through a U.S. service delivery network; and the services are reported on Form 2105 or 2106 as they flow through the firm's U.S. service delivery system, including its U.S. operations if it has active U.S. operations;

a broker (i.e., a professional trading firm) with a U.S. branch who trades U.S. Treasuries, agency debt, agency mortgages, municipal securities, or any of the other securities included in the SIC tables and who has no U.S. employees.

To determine whether a trade involves a service with the U.S. government, an entity must check an applicable box on Form 2105, Form 2106, or Form 2107, depending on the type of transaction. The form 2105 and 2106 provide the address and telephone number of the U. S. Treasury's Foreign Trade Division.

Note. If you conduct a business with the U.S. government and the U.S. government provides services to you, you are treated as having engaged in a trade for U.S. income tax purposes. For more information, see the instructions for Form 8848 and its instructions.

How do I calculate the amount of the U.S. service delivery network deduction?

The first step to figuring the U.S. service delivery network deduction for Form 1099-MISC is to find the location of the service in accordance with the service details. For information about the service details, see the Form 2105, Form 2106, or Form 2107 instructions. The IRS requires that the address of the U.S. government be reported for all purchases and other taxable transactions that involve U.S. government property if you use Form 2105, Form 2106, or Form 2107 and the U.S. government is the taxable entity as described under the heading Where is the U.S.

How do I get my Form 1099-MISC?

You may obtain Form 1099-MISC for a tax year with no prior returns from the IRS Online services at. This service is available as follows:

On the 'My Account' page, select 'Forms and Publications.' Select 'Search for Publications' and enter 'MISC' as the search term. Select either 'All Forms' or 'MISC.'

If you do not have a 'My Account' page, you may obtain a copy of Form 1099-MISC by contacting Customer Service at.

How do I access a complete online copy of my Form 1099-MISC?

You can get a complete, electronic copy of your Form 1099-MISC at a later date from the IRS. You can call 1-800-TAX-FORM); visit to access the form online; or log onto IRS.gov and enter 'MISC.' The document will be emailed to you.

Do I have to file my 1099-MISC forms with my tax return?

No. While filing Form 1099-MISC, you must report all amounts withheld, or treated as withheld, as income. You should complete and file IRS Form 1040X, U.S. Individual Income Tax Return, if you itemize deductions in connection with your Form 1099-MISC. You should file Form 1040X along with a Schedule C to report estimated tax and itemized deductions on your income tax return, as described under How Do I Report My Income. If you are filing a joint return, you must file the 1040X with the joint return, and then file Form 1040 as the sole taxpayer on Schedule A. However, if another taxpayer has paid more tax than you have, you should not include that amount on Form 1099-MISC.

If I am an employee and file Form 1099-MISC should I include this information in my 1040X?

Yes, you should. All employees should include this information in their 1040X for tax reporting purposes.

What documents do I need to attach to my Form 1099-MISC?

You cannot attach your Forms 1099-MISC to personal income tax returns other than those reporting your income in the form of capital gain (if you are not a U.S. citizen or resident) or capital destruction income (if you are a U.S. citizen or resident). When you submit your Form 1099-MISC to your employer, however, attach a copy of the IRS instructions for Form 1099-MISC.

The instructions for Form 1099-MISC will give you the basic information you need to figure your deduction. See the instructions for Form 1099-MISC, later.

If your Form 1099-MISC shows less than 120, you can take a 3 (or 6) deduction for each item. If your Form 1099-MISC shows 120 or more, you can make a deduction of up to 15 (or 60) for each item.

How do I fill out Form 1099-MISC?

Complete the following information on the front or back of the form in accordance with IRS instructions. Do not forget to save your forms. You can also use these instructions to fill out the Forms 1099-MISC.

What Form 1099-MISC do I need to submit to a third party?

For information on sending Form 1099-MISC to an employer, please write us at the address below.

Where Do I File?

For information on filing a return using the 1099-MISC form, please write us at the address below.

For the 2016 tax year, see the 2016 Form 1099-MISC Instructions in Related Resources for more information.

If You Are a U.S. Citizen or Resident and Not a Resident Alien (Foreign National)

If you are a U.S. citizen or resident, you will be required to report only income earned in the United States, with limited exceptions.

You do need to follow some U.S. tax laws, however, including:

The requirements for Form W-2 and Form 1099-MISC are different depending upon your particular circumstances and whether you are a:

If You Are a Non-U.S. Citizen or Resident Alien

You do not have to provide any further information or documents to determine whether you were a U.S.

What are the different types of Form 1099-MISC?

All types of Forms 1099-MISC are processed by various IRS field offices.

These forms are used by third parties for payment. Third parties include vendors, vendors' employees, and individuals who make payments to vendors' employees. These include, but are not limited to, vendors, subcontractors, and suppliers. Third parties who use the Forms 1099-MISC include, but are not limited to: Vendors.

Contractors (who are reimbursed for work performed by a contractor's employees)

Loan companies

Insurance companies (including auto and property insurance)

Finance companies

Banking institutions (“Lenders”) who pay on account on a periodic basis

Payment processors (including check cashing firms and credit card companies)

Employees or owners of banks or credit card companies

Lenders who receive payments from these entities

Finance companies that receive payments from these customers, such as an auto dealer or a realtor

The forms are also used by individuals for employment expenses, but individual Forms 1099-MISC are not used for individual employment expenses. This includes, but is not limited to, medical, dental, and other similar expenses.

How do I use the different types of forms in these FAQs?

When you file a tax return or pay your monthly bill, go to each individual (Form 1099-MISC) line and follow the instructions for your form.

How can I determine if I made a valid payment or received a wrong Form 1099-MISC?

To determine whether a payment, payment in error, Form 1099-MISC, or other information is valid or incorrect, check the following:

To make a payment or other payment, go to each individual Form 1099-MISC line and follow the instructions for the form. Payees who make payments under these different types of forms should ensure that their tax return or other payment is on file if they intend to file a return under a different type of form. Mayors who make Form 1099-MISC payments should ensure that they provide clear and convincing evidence of the source of the income, that is, the entity with which they have an employment relationship.

If you received a Form 1099-MISC for taxable income, follow the instructions in the instructions that accompany the Form 1099-MISC.

How many people fill out Form 1099-MISC each year?

The IRS doesn't publish the figure. However, the agency estimates the total number of forms mailed to taxpayers in the United States to be about 2.6 billion in 2014, with a majority of those returns filed in Form 8949. (For more information, see IRS Guide: Forms — Other Information.) For more information, see Who Received a Form 1099-MISC in 2014?

What does a Form 1099-MISC show?

The IRS issues a Form 1099-MISC when you sell assets or earn income from assets sold and not reported on Schedule C. These assets include:

business assets,

personal property, and

business income,

To determine the type of assets sold, use Form 8914 to report the disposition of your business or personal residences. Business property is any business assets that meet the requirements for a business. Personal property is any real property, cash, and other property (including vehicles) that you hold for use in the conduct of a trade or business. Business income includes both: Business profits on business owned inventory. Your inventory is inventory that represents the value of the property that you, or a person you designate, bought, used, or disposed of during the calendar year.

The dollar value of an asset when it is placed in service to be sold when it is no longer being used for the business.

Any other income from any other source such as wages, salaries, commissions, gifts, royalties, rents, dividends, interest, dividends from partnerships, other trusts and estates, annuities, and certain rental payments. Note This includes any profits that must be distributed to shareholders as dividends that can be distributed in any year. This income is reported on Form 1099-DIV.

Examples of the types of dispositions that can be reported in an income tax return are: Disposition of personal property to pay debts or related expenses to other related members of an entity, such as partners, or to provide relief to the victims of a disaster.

Change in ownership. Example. The following example illustrates how a change in ownership by the transferor can be entered as income. As part of a partnership's share of operating expenses, the share of partnership expenses that the partnership pays is taxed as an additional tax on the operating expenses of the partners. For this example, the partnership is a partnership that has received partnership operating expenses during the year. During the year, one member of the partnership was an officer of A.

Is there a due date for Form 1099-MISC?

You must file Form 1099-MISC no later than one year after the close of the year to which it relates.

How long can Form 1099-MISC be filed?

Form 1099-MISC can be filed for consecutive years. Once filed, though, the IRS will not consider any later amendments to be an addendum to the previous Form 1099-MISC.

What information should I include when I file Form 1099-MISC?

You should enter the information listed on Schedule C on the return, as requested. For Form 1099-MISC that is not filed with Schedule C, the following information needs to be entered in the “Instructions to Forms” tab of the electronic filing system to produce the correct tax return:

the taxpayer's name for use in reporting the taxpayer's gross income on the income tax return;

the information on each line on the return to report the gross income of the taxpayer, such as the gross amount of sales, gross amount of wages paid or salary or other compensation, gross amount of uncollectible debts, etc. You can enter the following information on line 4: the date of filing of the individual's return; the year; and the taxpayer's Social Security number or EIN number (if applicable). If you use Social Security number entry, it must match the taxpayer's Social Security number on the individual filing the return or, if necessary, his or her taxpayer identification number, or the individual's taxpayer identification number and the taxpayer's personal identification number (PIN).

You must enter the amount in the amount box.

You must enter every item on Schedule C that you are required to report, even if the total figure is zero.

What should I report?

Line 4 of Form 1099-MISC for individuals or the “Instructions to Forms,” line 18 on Form 1099-MISC for large businesses, and line 13 of Form 1099-MISC for partnerships must be entered.

Line 4 and line 13 of Form 1099-MISC should be entered as follows.

Line 4: All amounts on this line must be entered in the amount box. Enter the total for the line.

Line 13: This line must be entered as follows.

All amounts on this line must be entered in the amount box. Enter the total for the line. Enter the value of any item on line 6 or below.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here