Award-winning PDF software

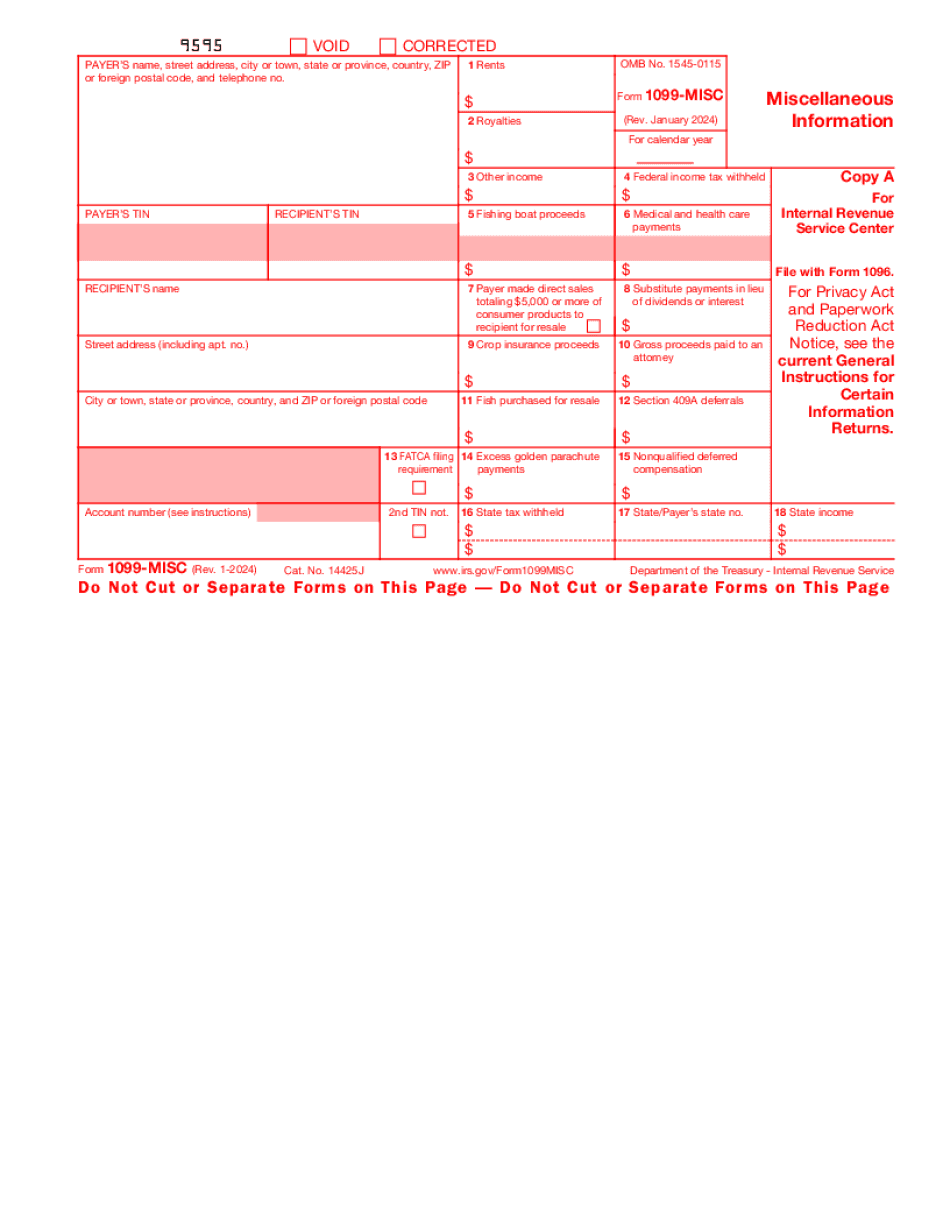

Tempe Arizona online Form 1099-MISC: What You Should Know

You must use your City of Tempe billing address; and mail your forms to the address provided and mail/fax the forms back to the same address. (You may fax forms to if you require a paper return.) Form 3125 — Unemployment Benefits The unemployment payment will not apply to a claim for unemployment benefits if you have never reported receipt of a check. You must contact the Phoenix Department of Commerce at or visit employment.state.AZ.gov. Flexible Spending Accounts If you have not filed your federal tax return for the year prior to the first of the tax years you want or need to use the Flexible Spending Account (FSA) or you have failed to file your federal tax return before the deadline, we will apply up to 3,500 for one year to your FSA if you have not claimed or used your FSA. If you used an FSA or you are seeking to claim an FSA for the year immediately before the year we apply the award to, please obtain a certified copy of your tax return prior to the year the FSA is to be used for, or submit that tax return to the Department of Commerce before January 1. If you are claiming an FSA for the 2025 tax year, and you did not file your 2025 federal tax return, please submit this information with your claim. Claim for Flexible Spending Account 1. Identify one of the following income sources, to which you are eligible for an FSA or would qualify under Section 529 College Savings Plan, and pay an annual contribution of Maximum contribution 2,500 Each additional 500 for each child Example: The maximum income level for a child who will attend a private school is the same as the annual earnings level for an adult who earns 1,500,000 per year for 10 years. Child's earnings are 20,000 per year. 2. Complete and attach with Schedule SE, if applicable, for the applicable calendar year the required Schedule SE tax information required for the eligibility of the child for an FSA. See Schedule SE for the full details about Schedule SE. 3.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Tempe Arizona online Form 1099-MISC, keep away from glitches and furnish it inside a timely method:

How to complete a Tempe Arizona online Form 1099-MISC?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Tempe Arizona online Form 1099-MISC aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Tempe Arizona online Form 1099-MISC from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.